The most comprehensive guide to the FI/RE movement on the internet!

If you made it to this page, you are clearly interested in leaving the work force at some point, probably sooner rather than later. You have stumbled into the world of the FI/RE movement and need more information. Well, you have come to the right place. Lets get started.

What is FI/RE?

FI/RE is an acronym for Financial Independence/Retire Early. Followers of the FI/RE lifestyle aim to achieve financial independence and early retirement.

People in the FI/RE movement define financial independence as having a sum of money large enough to cover all of their living expenses without ever running dry. Thus eliminating the need to work for money and allowing for retirement before the socially acceptable age of 62 or 65.

They aim to achieve this by living below their means in order to maximize savings. They use the 25x and 4% rule as rules of thumb to guide them. (More on these rules of thumb later)

Why am I writing this article?

OK so I had to address this at some point. I know quite a bit of what I write about on this website has been covered more poetically by guys like Mr Money Mustache. I am certainly not the first person to discover it is possible to retire early (neither was he) and I certainly wont be the last. But am I just another FI/RE movement guy? What even is the FI/RE movement.

While I was able to find dozens of financial blogs and forums and dudes talking about this stuff, I was unable to find a really good comprehensive definition of what we are talking about here. I think people have gotten confused and all wrapped up in what exactly it means to be frugal or learn to save. Some go to extremes eliminating any discretionary spending or fun money. Others may want to simply live a comfortable lifestyle while sacking away some extra cash.

There is an ocean of space between the philosophy of someone who is saving 80% of their salary and living in a box in order to retire early vs someone who still dines at a fancy restaurant once a month and leases a car at $400 a month but is also working towards early retirement.

In this article I will aim to do what the rest of the Fire movement poets have thus far, in my opinion, failed to do; and that is to give the most complete, detailed honest, and comprehensive guide to the Fire movement that I believe is absent from the internet.

I have my own beliefs and I have my own strategy that works for me and I write about that on this website as do others on theirs. But I started to think back to when I really first started doing research on what it would take to retire early, then super early. The research was all over the place. Hopefully I will succeed in bringing all of the information together in one place kind of a chapter one for anyone just getting started investigating the Fire movement.

History

The Fire movement has been around for as long as people have been trading time for money in these things we call jobs. (It simply lacked its current name.) It is inevitable that at some point every man and woman on the planet who has ever worked will stop working forever. Even if it is because you are dead.

I’m sure the first time in history that someone got sick of their job they woke up one morning and said “I don’t wanna do this shit no more but, I ain’t got no money” Thus retirement planning was born.

The fundamental personal finance strategies used to achieve FI/RE can be seen in written form as far back as 1926 in George S Clayton’s timeless classic book, The Richest Man in Babylon.

The idea of extreme early retirement (decades before the generally accepted age of 65) has really gained momentum in the last decade or so. Mostly through online forums, websites and blogs.

Along with this increase in interest of the subject has come a refined definition of what it means to be retired. When most people think of retired, they think of an old couple in their 60’s or 70’s sitting on a bench in a park together somewhere in Florida, feeding the birds before they retreat back to their retirement community for the Tuesday night buffet and bingo bonanza.

The FIRE movement has a different definition of retired. To them it is not about quitting working forever. It is about having the flexibility to CHOOSE to work… or not to work. Mr Money Mustache said it best, “work is more fun when you don’t have to do it.”

Lifestyle

For those in the FI/RE movement, retirement is about lifestyle. The choices we make to live a certain lifestyle now so we can live the desired lifestyle later. In general, the basic principle is to sacrifice now so you don’t have to later.

So by sacrificing wants and living a frugal lifestyle now, one can save enough money so they are not required to make the greatest sacrifice later. And this is the fundamental philosophy of the FI/RE movement that is not talked about enough in my opinion.

And that is the desire to live the life you want. The unwillingness to submit to the conventional thinking that we must all trade out most valuable commodity, time, for money.

The heart of the FI/RE movement

At the heart of the FI/RE movement and anyone who has researched early retirement, thought about it, or is actively working towards it; at the heart of it all is the desire to not be controlled.

FREEDOM

We are talking about freedom here. FI/RE movement followers only true desire is for freedom. Lets face it, if you are trading your time for money at a job, even one you love, you do not feel truly free.

Time is all we have. Money is made, money is earned, money is spent. And then we can always make more money. But once you are out of time, that’s it folks. You can not replace your time, once it gone, its fucking gone.

Like Forever.

People in the FI/RE movement have figured this out. They are also realists and realize that they need money in order to provide the life essentials. Food, water, shelter, clothes, beer etc. Ok maybe not beer but you get it.

The difference in the many forms the FI/RE movement has taken on, which will discuss shortly, is the level to which one is willing to sacrifice. Are you so driven to never work that you are willing to forgo all leisure activities now in order to have no work responsibilities alter? Or do you want to enjoy all that life has to offer now and spend every penny even if it means working until you are dead?

The FI/RE movement has evolved and take on different identities for folks at different levels in that spectrum. Before we get to that, lets look at just what are the financial principles at play in FI/RE.

FI/RE movement basic principles

The basic principle at work in FI/RE is spend less than you earn, save and invest the rest, and grow it to 25x your annual spending. At 25x your annual spending, you should be able to withdraw 4% annually (adjusted for inflation) in perpetuity.

The math will confirm that the higher your savings rate, the less years you will be required to work before reaching financial independence. So for example, if you can save 50% of your earnings and maintain the same spending in retirement, you should only need to work 17 years.

They even created a simple chart as seen here taken directly from Mr Money Mustache himself.

How does it work

I know I just made this seem incredibly simple without really explaining any of it in depth. So lets slow down and take this step by step.

Step 1 – Spend less than you earn

This has to be the easiest concept to understand. If you make $60,000 a year and your annual spending is $65,00 clearly you’re fucked. In order for any of this to work, the money coming in needs to exceed the money going out. Debt is not an option. So frugality and sacrifice must prevail.

Step 2 – Save and invest the rest

Once you have a surplus of money coming in, you can’t just put it in a glass jar. You need to be investing it and growing the balance over time. The investment of choice in the FI/RE movement seems to be low cost index funds. Based on historical data, they can be expected to grow at about 7% per year on average.

Step 3 – Save a nest egg equal or greater to 25x your annual spending

The 25x rule states that if you save 25x your annual spending and then follow the 4% safe withdraw rate, your money should outlive you. Therefore, if your annual spending is $50,000 per year, you would need to save $1,250,000 or more and maintain your current spending, adjusted for inflation and this would allow you to never work need to work for money again. This premise also relies on your investments to continue returning 7% annually on average.

Step 4 – Retire and follow the 4% rule

In order for any of this to work you would need to find a safe withdrawal rate that would allow you to live off of your nest egg and its returns and without ever completely depleting the balance. I wrote an entire article dedicated to the 4% rule, titled How long will my money last? The 4% rule simplified , which you can ready here.

Basically, it works like this. If you are earning 7% and Inflation continues to be around 2%-3% as it has been historically, then the difference of 4% is what is left for you to withdraw. Therefore you are basically living off of the earnings and never touch the balance of your nest egg.

It seems simple enough right? Four easy steps. But even if you can manage to save 75% of your earnings through serious sacrifice. Seven years is a long time to go without ever going out for a steak dinner, or even a simple frappuccino. What happens when you get a raise? The fridge breaks down and now you need a new one, there goes your budget?

There needs to be wiggle room for life events and changes in the plan. Well, the FI/RE movement understands this and has gone on to define a bunch of different variations of FI/RE. They are as follows.

FI/RE Variants

Fat Fire

Do you feel a strong desire to leave the work force forever but wish to live it up in retirement? Then Fat FI/RE is for you. Fat FI/RE aims to allow you to retire without sacrificing your spending.

People who use Fat FI/RE believe there is no point retiring early if you’re constantly worried about the monthly bills. With Fat FI/RE you a truly free to live life on your terms.

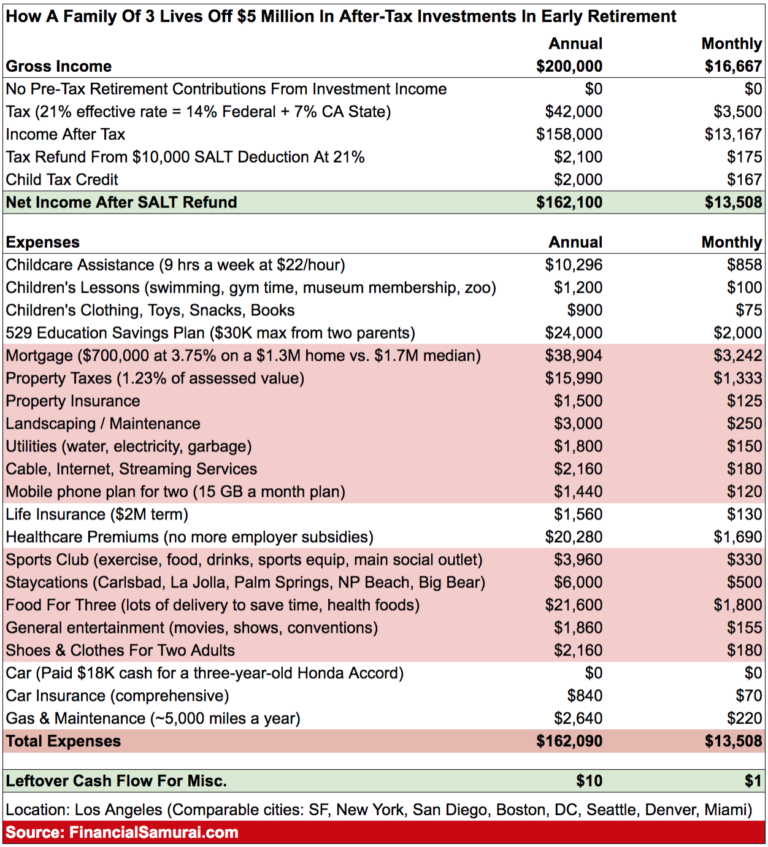

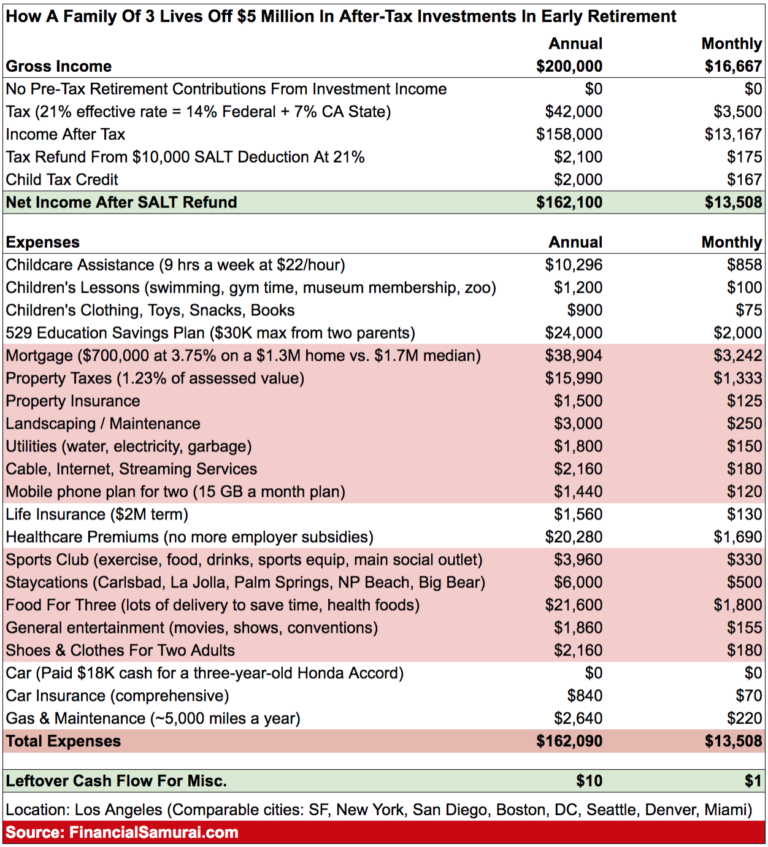

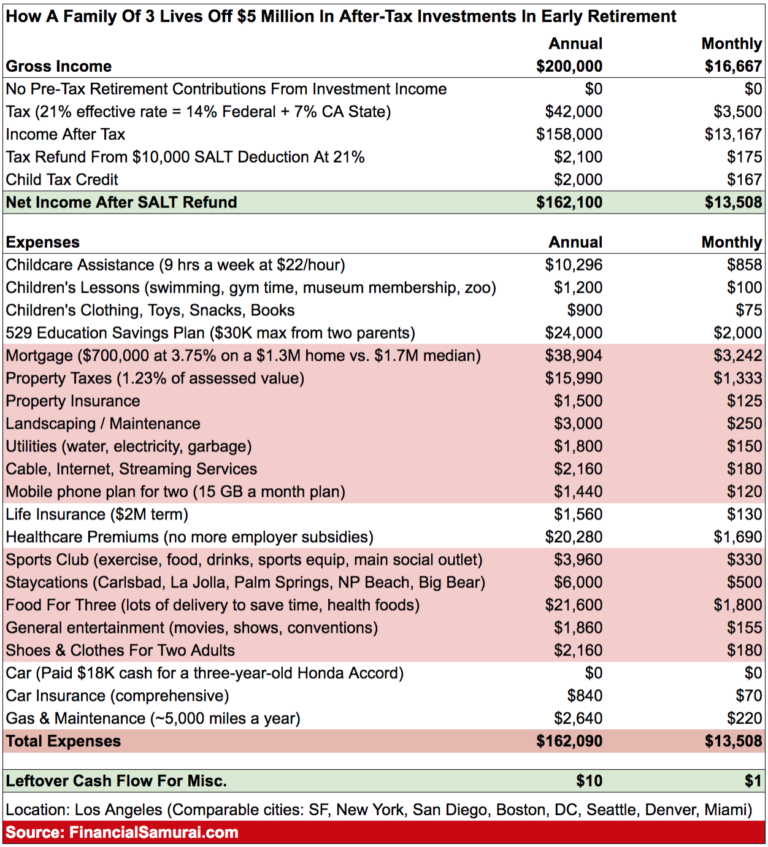

Here is an example of an expense report for a family of 3 on Fat FI/RE courtesy of financialsamurai.com

As you can see in the chart, their living expenses are quite high. They have spared no expense and are not afraid to live a lavish lifestyle in retirement.

Lean FI/RE

Lean FI/RE is the opposite of fat FI/RE. with Lean FI/RE you learn to live a frugal lifestyle. Spending is limited to the essentials. Budgeting is essential and discretionary spending almost non-existent. With Lean FI/RE you must learn to control spending urges and be willing to make sacrifices on such things as where you will live or what kind of car you will own (if any).

Lean FI/RE teaches you how to make the most of every dollar. Some people chose to live a Lean FI/RE lifestyle while working in preparation of living a Fat FI/RE lifestyle after retirement. This is basically where you sacrifice spending during your working years and save as much as possible. The difference is that you are planning on an actual increase in spending once retirement begins.

Lean Fire is not for everyone. It takes serious discipline to live a lean lifestyle for years to achieve the reward of super early retirement.

FI/RE

In between Lean and Fat is regular FI/RE. This is where you follow the same basic principles but do not lean to the extreme on either end of the spectrum. I would use the word reasonably aggressive to describe the frugal spending and savings habits.

Coast FI/RE

Another interesting variant is Coast FI/RE. With Coast FI/RE, you have enough in your retirement accounts that they will soon grow into a self sustaining nest egg capable of lasting forever utilizing the 4% rule. Until that day arrives, you are coasting with a job to pay the bills now to fill the time until that happens.

You are just coasting along until the time comes for you to start tapping in to your nest egg. At that point you will go full retirement and should have enough in your accounts to outlast you.

Barista FI/RE

Barista FI/RE is where you retire but you don’t quite have enough to cover the monthly bills. In this case you get a simple job to cover the expense deficit, something like a barista at a coffee shop for exemple. Hence the name Barista FI/RE.

Yet another reason someone might choose this way is for the health insurance offered by their employer. So they may not really need the money, but enjoy the benefit of health insurance that comes along with the job.

mini-retirement

The mini retirement is not really a form of FI/RE but it does share the core philosophy of work being a requirement only to provide us opportunity to enjoy life. Mini retirements are a series of intentional breaks in your career. With mini retirements, you make the choice to leave an employer or industry for a time before reentering the workforce at a later date.

Think of this as extended vacations. You use the principles of fire to sacrifice now and save enough money to quit the work force, enjoy life for a few months or years, and then go back to work to start the cycle all over again. This philosophy allows you to enjoy these mini retirements now while you are still young while never burning out on your career.

Criticism

There are many criticisms of the FI/RE movement. Some are just plain nonsense and take into account the average 401k savings of people in their 40’s. What these criticisms fail to understand is that FI/RE savers are not average savers. They go to extremes and live a lifestyle much different than the average person.

Other critics will claim that it is only for people with high incomes and that savings rates of 50% or more are simply not possible. This has also been disprove time and again not only by using simple math but in real life examples of average income people going to extreme lengths in order to attain the savings rate required to retire super early.

Still others will point to flaws in the 4% safe withdrawal rate. They will point out (correctly) that we don’t know what the future holds. Inflation may be higher in the future than it has been historically. the stock market may not continue to deliver the returns it has over the last 100 years. This is true, they might not. They might also go the opposite direction. Nobody knows.

FI/RE does not claim to predict the future. What it aims to do is provide the best possible picture of the future using a long range of past data as a predictor. It is all we have.

Suze Orman HATES HATES HATES FI/RE

Perhaps the most famous of FI/RE’s detractors is famed financial advisor Suze Orman. She said in an interview that she absolutely hated the idea of early retirement and that someone working now would need $5 or $6 million to retire.

One of the point she made in the interview, although poorly communicated by her, is that by retiring early you are forfeiting years of compound interest and exponential growth on your savings. This is absolutely true and a great point. When you retire, you not only stop contributing to these accounts but start drawing upon them and completely kill the growth momentum.

I think what Orman misses is the whole point of the movement. These people are not interested in amassing a huge ball of money. What they are interested in is escaping what they perceive as a situation where they are forced to work for wages and into a position of financial security that will allow them to choose to continue to work if they so desire.

Her statement that you will need $6 million sounds like some fear mongering world is on fire BS to me. I’m not quite sure what she is basing that on but my opinion is that if the economy is in that bad of shape it wont really matter anyway.

My thoughts

Achieving financial independence is not about sitting on a beach somewhere for the rest of your life. It is about taking control of your life through your finances. It is about obtaining the freedom to choose how you will spend your time.

I discovered that I had the ability to shape my financial future decades later then I wish I had. I wasted alot of time and money, like most people, believing what I was taught by school and life. That you must work for wages and slowly save your money and hopefully you won’t die before you can retire.

I think the most important thing to remember is that building wealth is not something that only high income earners are capable of. Many of us give up before we ever get started because of this false belief. Maybe you won’t be able to retire at 40 but you will still be far better off then if you hadn’t tried at all. Maybe instead you retire at 55 instead but it is still better than 65.

What everyone else missed

I think the other important part of FI/RE that almost everyone missed is that there is no right or wrong way to do it. One size does not fit all but actually, one size might not fit any. For example, you might start by learning about the frugality involved in Lean FI/RE and think there is no way that is for you. But you don’t even consider the other alternatives. I would go so far as to say what works for you in your 20’s might not in your 30’s and you might change again in your 40’s.

For example, In my early 20’s I was forced to be a saver. I had very low income, and was forced into a frugal lifestyle. In my late 20’s as I began making some more money, I was a saver concerned with my future but I also wanted to go out ant party so I did not put as much focus on saving as a Lean FI/RE advocate might want me to. Then in my 30’s I became more responsible and was more Lean.

By my 40’s I was all in. I had had enough of the work life. I came to the realization that this was not the way we should live. My mistakes had been made already. I do not regret my decisions. They made me who I am. I do wish I would have been a bit smarter with my money from time to time.

The point of this is that FI/RE needs to be a living entity for each individual at different points in their life. I think we forget just how long the journey is. We evolve as people and so should our financial habits.

All apologies to Mr Money Mustache and the Financial Samurai but you can’t look at a chart and say “I am going to save 50% of my income for the next 7 years and then live the exact same lifestyle forever.” It is called Personal Finance for a reason. You are forgetting the person involved. It is not realistic to think someone will have the same annual spending at age 20 that they will when they are 60. People change and so do their spending habits.

May I suggest a new variant…

FI/RE Evolve

In FI/RE Evolve, your financial decisions are allowed the freedom to evolve along with you as a person. The main philosophy is still alive. Spend less than you earn and save and invest the rest with the goal of achieving financial freedom. The only difference is the aggressiveness with which you pursue the goal line evolves as you do.

Financial Independence should be a goal for all of us. Life is too short to be spent at work. Even a job you love is taking time away from other things you like to do. Unless your job is the only thing you love or your favorite way to spend your time, you will at some point want to have the financial stability to walk away from it. FI/RE, in any of its many forms, offers you that possibility.

If nothing else, I hope you take away from this the knowledge of what is possible. For all the past decisions I made that could have changed my current financial situation, my one biggest regret will always remain not educating myself on what is actually possible.

I implore you to continue your research and maybe even make some baby steps to test the waters. Do something so you won’t end up burning with no hope for walking away on your own terms.

Thanks for staying with me to the end

Earl